The original 13 colonies have significant Taxpayer Burdens

The men and women who sailed to America in the 1600s in search of a new life would not be too proud of their former colonies today. The 13 original colonies have grown exponentially throughout the years. New York even has the largest populated city in the United States. But who has been paying for the development in these 13 states? Taxpayers.

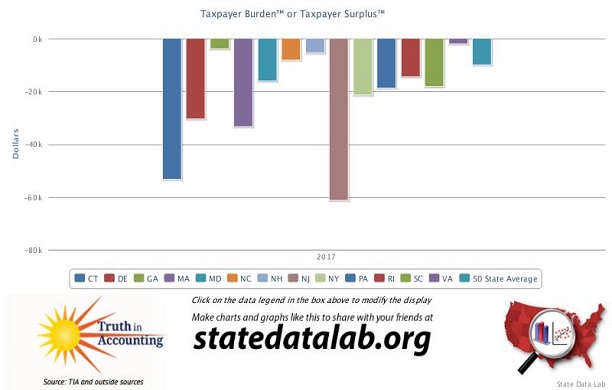

Independence Day is here once again and many will be celebrating the holiday. What many will not be celebrating is their share of state debt. We break down each taxpayer’s share of state debt into a per-Taxpayer Burden. The states that were the original 13 colonies have a pretty hefty Taxpayer Burden compared to the 50-state average. In the 2018 Financial State of the States, New Jersey found itself ranked No. 50, or last, with a Taxpayer Burden of -$61,400. Other former colonies that found themselves in the bottom 10 positions of the Financial State of the States were Connecticut (No. 49), Massachusetts (No. 46), Delaware (No. 44), New York (No. 42), Vermont (No. 41), and Pennsylvania (No. 40).

The older the state, the worse off it is because it has had more time to accumulate debt. The debt racked up by the original 13 colonies is largely caused by the respective states’ elected officials not funding the retirement benefits that were promised to the state employees. With this opaque accounting, citizens cannot be knowledgeable participants in our democracy.