What's the tax breakdown in your state?

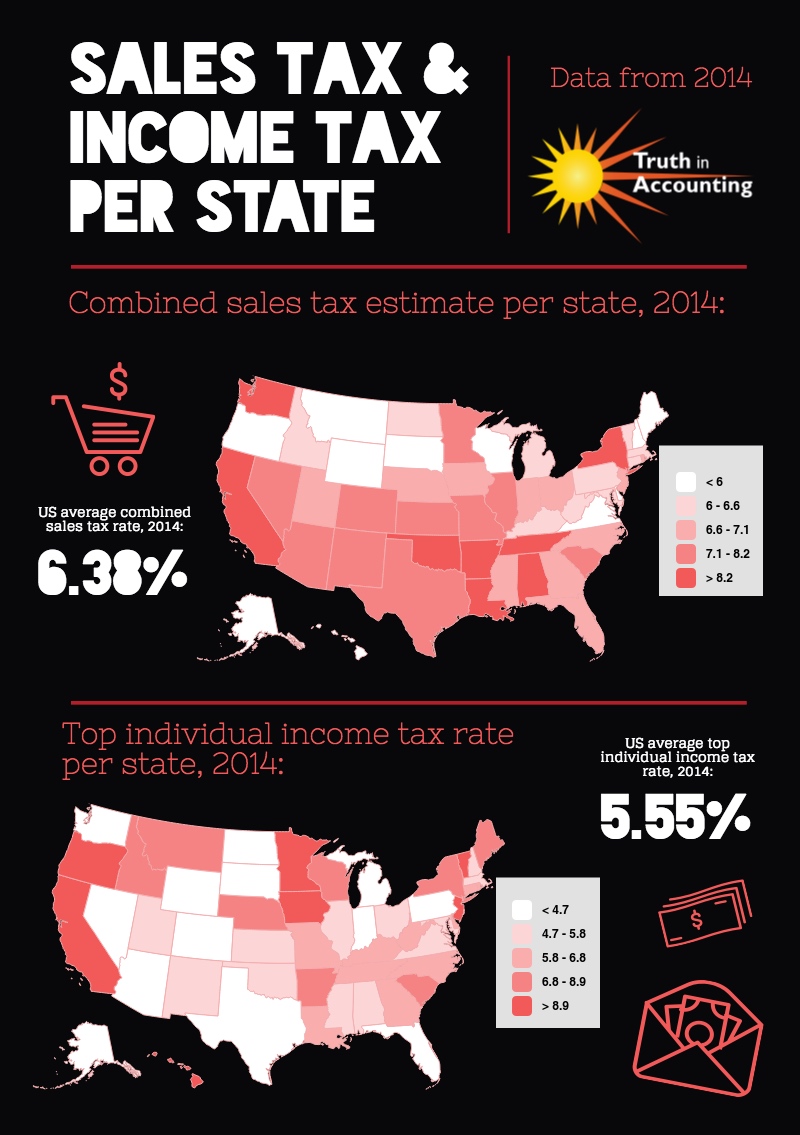

Many Americans flock to states with little-to-no income tax, but are these states really that low in taxes? Specifically, do other types of taxes bridge the gap? According to data from Truth in Accounting's State Data Lab, states with low rates or no income tax often have high sales tax rates to balance the scales. The same applies to states with high income taxes; for example, Oregon has the third highest income tax rate in the nation, but it has no state-level sales tax. Its neighbor, Washington, has no state income tax, but has an average statewide sales tax rate of 8.88%--fourth highest in the country.

Though this polarity exists in many states, it's important to note that states with income tax rates close to the national average (5.55%) also often have sales tax rates that are similarly moderate. California is an exception to this general rule of proportion: both the sales tax and income tax rates are among the highest in the nation.

Where does your state rank in terms of tax rates? Find out using the State Data Lab.